do nonprofits pay taxes on lottery winnings

Yes nonprofits must pay federal and state payroll taxes. Up to 13 can be withheld in local and state taxes depending on where you live.

Guy Who Won 5 6m Dollars Refused To Give Any To His Family Bored Panda

You must report any.

. That means your winnings are taxed the same as your wages or salary. The states that do not levy an individual income tax are. The federal tax rate for lottery winnings totally depends on the number of lottery winnings and can go up to a maximum of 37.

Most prize winners pay a fixed federal income tax rate of 24 on their lottery winnings over 59999. Your recognition as a 501 c 3 organization exempts you from federal income tax. Gambling and lottery winnings is a separate class of income under Pennsylvania.

The Worst States for Lottery Taxes. Oregon takes second place. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members.

But nonprofits still have to pay. Florida New Hampshire Tennessee Texas South akota Washington and WyomingFive states do not have a lottery. Section 671b of the Tax Law and Section 11-1771b.

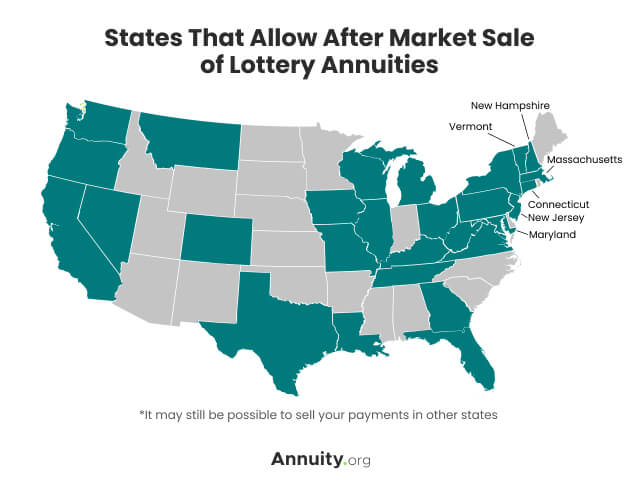

And you must report the entire amount you receive each year on your tax return. New Jersey comes in as the worst state for lottery taxes with a top tax rate of 1075 as of the 2021 tax year. Taxes on lottery winnings by state local tax.

The Internal Revenue Service considers lottery money as gambling winnings which are taxed as ordinary incomeThe total amount of tax you pay on your lottery winnings. However a nonresident of Wisconsin must have. Gambling and Lottery Winnings do seniors pay taxes on lottery winnings Class of Income.

However if your newfound wealth puts you in the top tax bracket this. Both cash and the value of prizes are considered other income on your Form 1040If you score big you might even receive a Form W-2G reporting your winnings. If you claimed a winning lottery ticket in your name you would owe taxes to the feds and state and probably local municipality depends on.

For example lets say you elected to. How much you can donate depends on your other income and the type of charity to which you make the gift. An organization that pays raffle prizes must withhold 25 from the winnings and report this amount to the IRS on Form W -2G.

The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members. If you take its annuity value youll have to pay taxes every year. All winnings from the lottery are subject to tax but its not as simple as paying for it the year you won.

How much you earn. While seniors are exempt from certain types of taxes like property or income taxes under specific regulations they cannot remain exempt from paying taxes on. Whenever you see a dollar from a lottery win please remember that the IRS has taken its 25.

Withholding Tax on Raffle Prizes Regular Gambling Withholding. Your state will tax the winnings too. Up to 25 cash back To prevent abuses and tax evasion the IRS imposes some strict requirements on nonprofits involved with gaming activityfor example.

If you win in 2020 and give the winnings to a public charity you can.

Lottery Tax Rates Vary Greatly By State Tax Foundation

Despite Law Changes Lottery Winners Will Face Big Tax Bills Wztv

/cloudfront-us-east-1.images.arcpublishing.com/gray/64L27HJRDBH6JKU5SPI2V44TCM.png)

This Is A Big Big Win For South Carolina How A Winning Ticket Impacts The State

How Are Lottery Winnings Taxed Blog Casey Peterson Ltd

How Much Is Lottery Tax How To Pay Lottery Tax In The Various States

Where Do Lottery Profits Go States Use Them To Bolster Their Budgets Here Now

Is It Worth Paying For A 2 Mega Millions Ticket To Get A Shot At 810 Million It Depends Pennlive Com

One More Thing To Do When You Win The Lottery

/cloudfront-us-east-1.images.arcpublishing.com/gray/INERGVTYABDMRNHYE2HFUU2WUA.jpg)

This Is A Big Big Win For South Carolina How A Winning Ticket Impacts The State

Taxes On The Lottery Momsintow

Is 810 Million Worth A 2 Mega Millions Ticket It Depends

Mega Millions Jackpot Winner S Name Might Always Be Kept Secret Npr

Can You Put Lottery Winnings In A Trust Fund Not Pay Taxes On Them

Lottery Payout Options Annuity Vs Lump Sum

Some People Repeatedly Win The Wisconsin Lottery Do They Play Fair Wisconsin Watch

How Taxes On Lottery Winnings Work Smartasset

9 Ways To Spend Your Lottery Winnings Trust Will