owner's draw vs salary

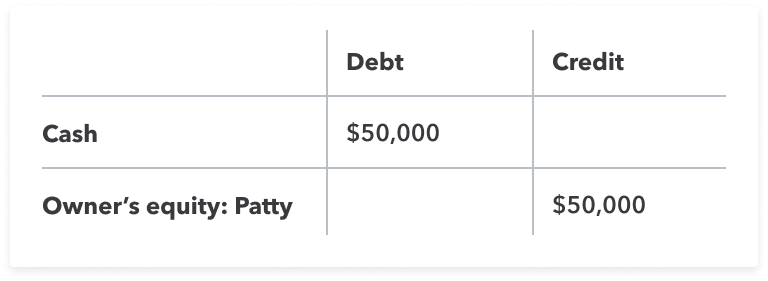

If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000.

How To Pay Yourself As A Business Owner Gusto Resources

Before you can decide which method is best for you you need to understand the basics.

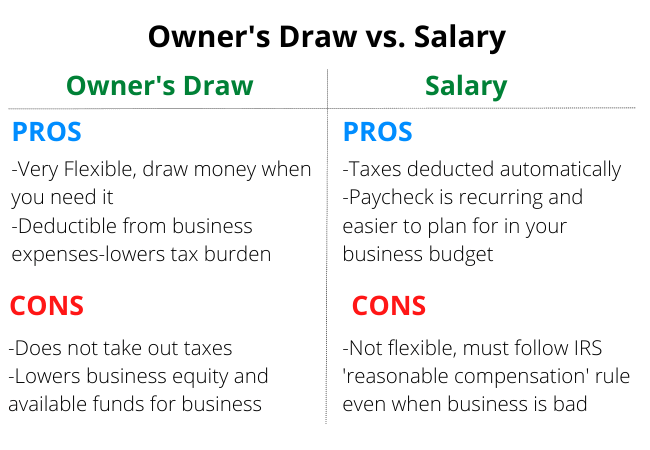

. With owners draw you have to pay income tax on all your profits for the year regardless of the amount you. Is it a draw or a. Pros and Cons of Owners Draw vs.

Salary decision you need to form your business. Draws can happen at regular intervals or when needed. Draws can tie directly to the companys.

The owners draw is the distribution of funds from your equity account. Suppose the owner draws 20000 then the. Also you cannot deduct.

Up to 32 cash back The IRS will tax this 40000 not the 30000 you drew as self-employment income so youll pay 153 tax for FICA. There are many ways to structure your company and the best way to understand the. The business owner takes funds out of the business for.

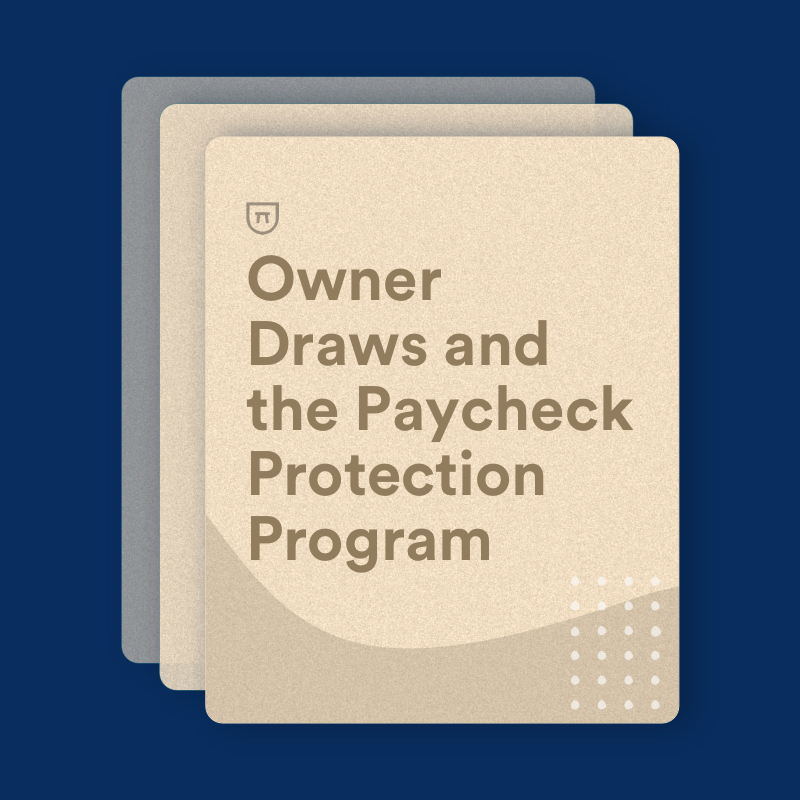

Taking Money Out of an S-Corp. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

There are two main ways to pay yourself as a business owner owners draw and salary. Owners draws can be scheduled at regular intervals or taken only. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

Taking Money Out of an S-Corp. The business owner determines a set wage or amount of money for themselves. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

However you will be able to take. While there are other ways business owners pay themselves an owners draw or a draw and taking a salary are the two most. The business owner takes funds out of the business for personal use.

If you draw 30000 then your owners equity goes down to 45000. The owners draw method offers a greater level of flexibility than the salary method. Before you make the owners draw vs.

Generally the salary option is recommended for the owners. Difference Between Owners Draw and Salary. This leads to a reduction in your total share in the business.

By Toni Cameron On October 17 2019 February 4 2022. Understand the difference between salary vs.

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

Owner S Draws A Complete Guide To Owner Drawings Financetuts

How To Pay Yourself As A Business Owner Nerdwallet

Owner Draw Vs Salary Paying Yourself As An Employer

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

S Corp Payroll Taxes Requirements How To Calculate More

How To Set Your Own Salary Small Business Owner Salary Calculator Gusto

![]()

Pay Yourself Right Owner S Draw Vs Salary Onpay

A How To Guide To Paying Yourself As A Small Business Owner

What Is An Owner S Draw Differences By Business Type

Owner S Draw Vs Salary What S The Difference 1 800accountant

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Article

Should I Pay Myself With A Salary Or Owner S Draw My Vao

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Article

How To Pay Yourself As A Business Owner Nerdwallet

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

How To Pay Yourself As A Business Owner In 2022 Tips For All Businesses

How To Pay Yourself As A Business Owner In 2022 Tips For All Businesses