property tax assistance program georgia

The Georgia State Income Tax Credit Program for Rehabilitated Historic Property allows eligible participants to apply for a state income tax credit equaling 25 percent of qualifying. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases.

Dma Corporate Tax Blog Property Tax

Property Tax Assistance Program Application Form PTAP 2022.

. Contact Customer Service Helena Office. The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply for an 8 12 -year property tax assessment freeze. For more information about the COVID-19.

Our staff has a proven. The stated purpose of the act was to. Georgia Preferential Property Tax Assessment Program Fact Sheet.

Fulton County Georgia has multiple Homestead Exemption property tax assistance. DRIVES will be unavailable on Saturday September 17 2022 from 130 pm until 1030 pm for scheduled maintenance. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners.

Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several. Georgia property tax relief inc. Coronavirus Tax Relief Information.

Property owners can choose to pay 0 full deferral 25 50 or 75 of the delinquent and future property taxes. Our staff has a proven record of substantially reducing property taxes for residential and commercial. Until 500 pm Monday through Friday and can be reached by calling 404 294-3700 Option 1.

Apply for Elderly Disabled Waiver Program. 406 444-6900 Office Locations. Georgia Mortgage Assistance Program.

DRIVES System Maintenance - Saturday 917. State Tax Incentives Available are two types of incentives including a state income tax credit equal to 25 percent of the projects Qualified Rehabilitation Expenditures and a property tax. Medicaid waiver programs provide recipients certain services not normally covered by Medicaid.

Targeted Property Tax Relief Program for Georgia. Contact the property tax department of your county or the largest local government to ask about hardship programs for property taxes. Look Into a Hardship Program.

Property taxes are paid annually in the county where the property is located. US Treasury Department allocated 99 billion to states and territories through the American Rescue Plan Act of 2021. Housing Tax Credit Program LIHTC The Housing Tax Credit Program allocates federal and state tax credits to owners of qualified rental properties who reserve all or a portion of their.

Faq State Of Georgia Rental Assistance Program Georgia Department Of Community Affairs

Handbook For Georgia Mayors And Councilmembers

Exemptions To Property Taxes Pickens County Georgia Government

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

Georgia Retirement Tax Friendliness Smartasset

18 States Are Sending Relief Payments To Residents Over Inflation

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How To File Taxes For Free In 2022 Money

Are There Any States With No Property Tax In 2022 Free Investor Guide

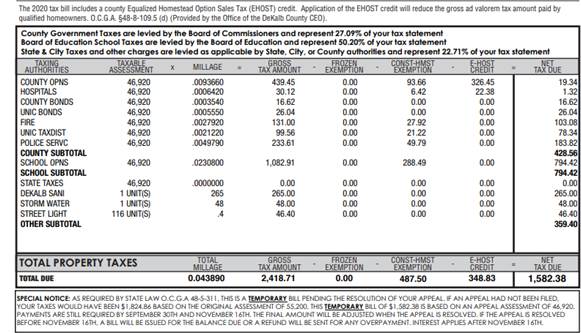

Property Tax Dekalb Tax Commissioner

Property Tax Appeals When How Why To Submit Plus A Sample Letter

United Way Of Rome Floyd County

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

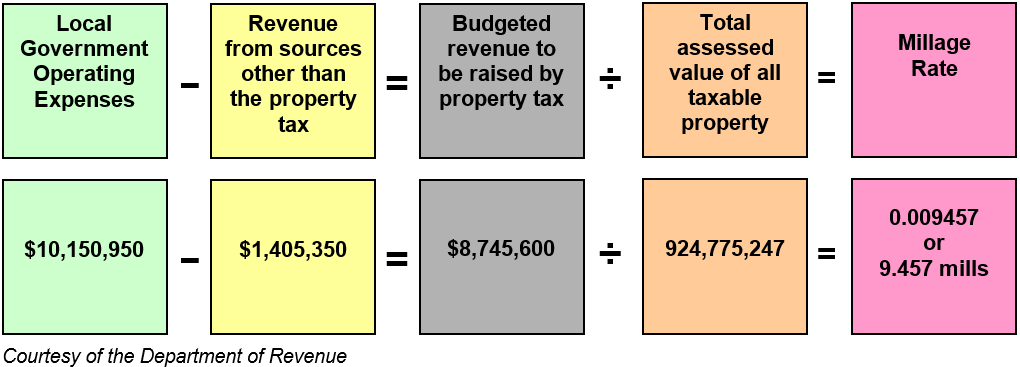

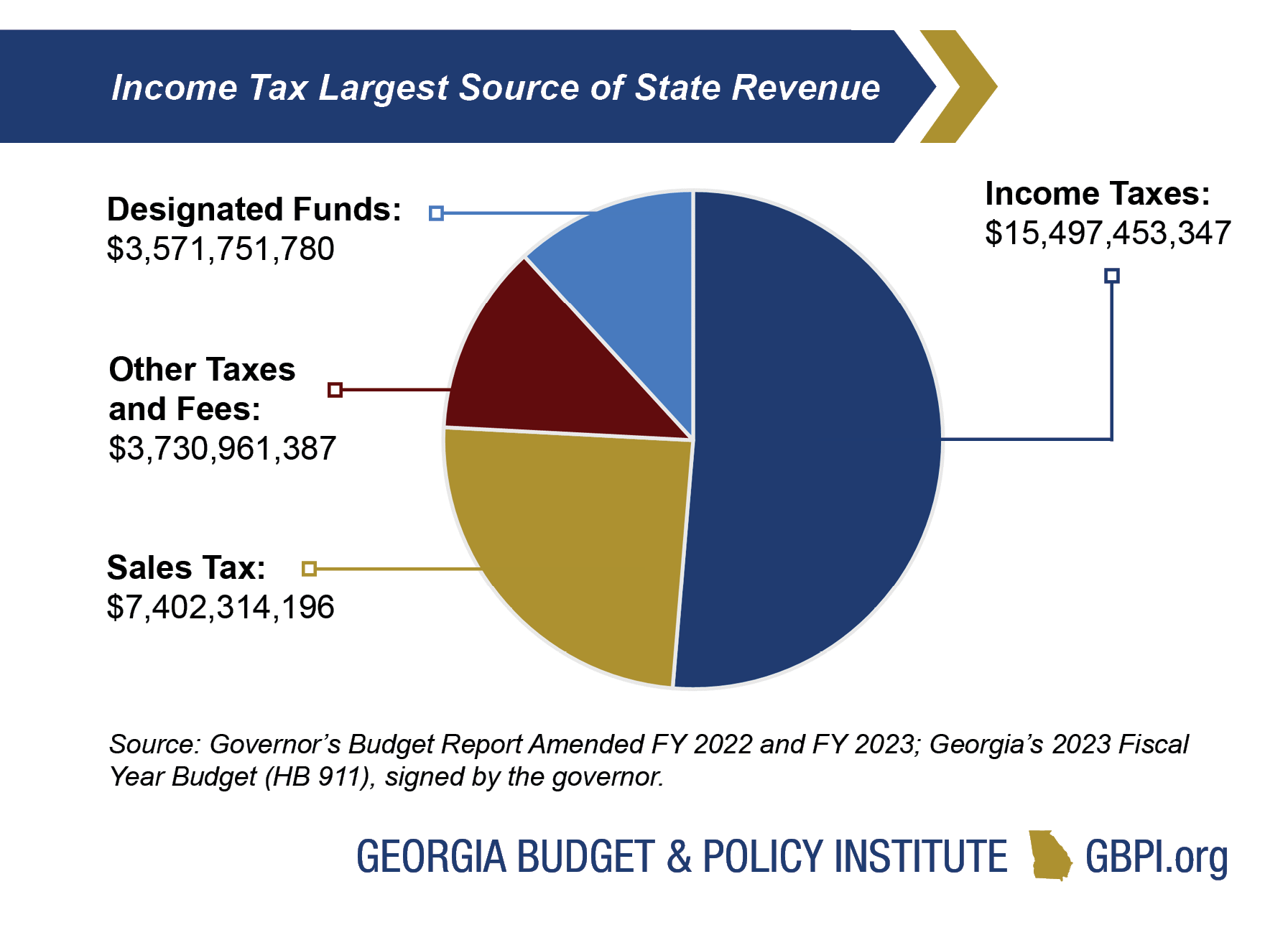

Georgia Revenue Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

Tax Rebates You Can Get Up To 500 In Tax Refunds Under The New Plan In Georgia Marca

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities